For almost ½ a century, owner capital project organizations have continued to improve the methodology to deliver value across their capital investment programs. Industry benchmarking through organizations such as the Construction Industry Institute (CII), Independent Project Analysis (IPA), and Pathfinder have offered data-driven capital project improvements over the past 4 decades. Whether called Front End Planning, Front End Loading, or Pre-Project Planning, these processes squeeze the most value out of every capital dollar spent.

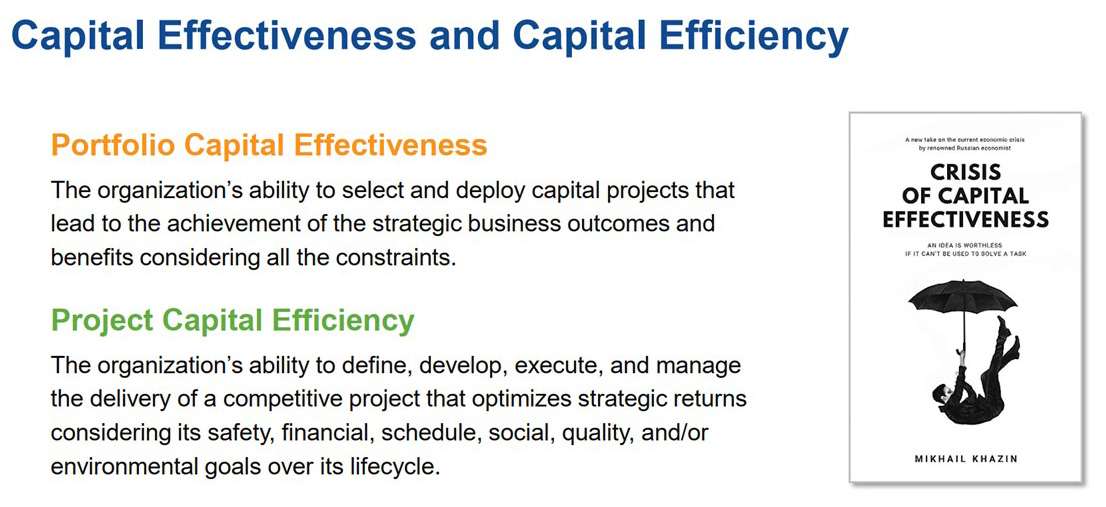

The industry respects the value that these processes deliver but it was realized that although the project delivery processes were providing a higher level of capital cost savings and more dependable project delivery timing. This equates to a high level of “capital efficiency” but the question remains, are we selecting the right projects?

Executing projects more efficiently provides great value but if we are not selecting the right projects within our capital portfolios, are we delivering the full value out of our capital programs?

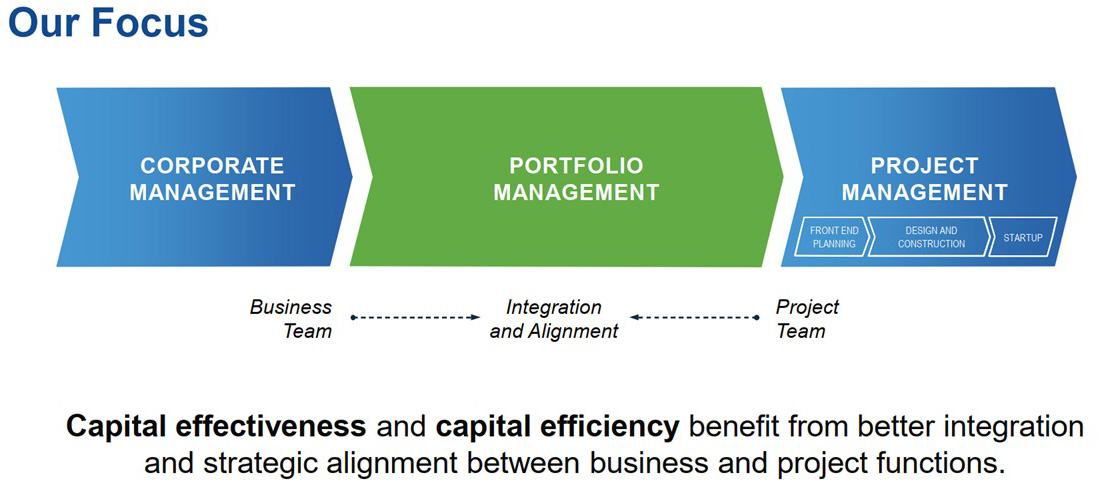

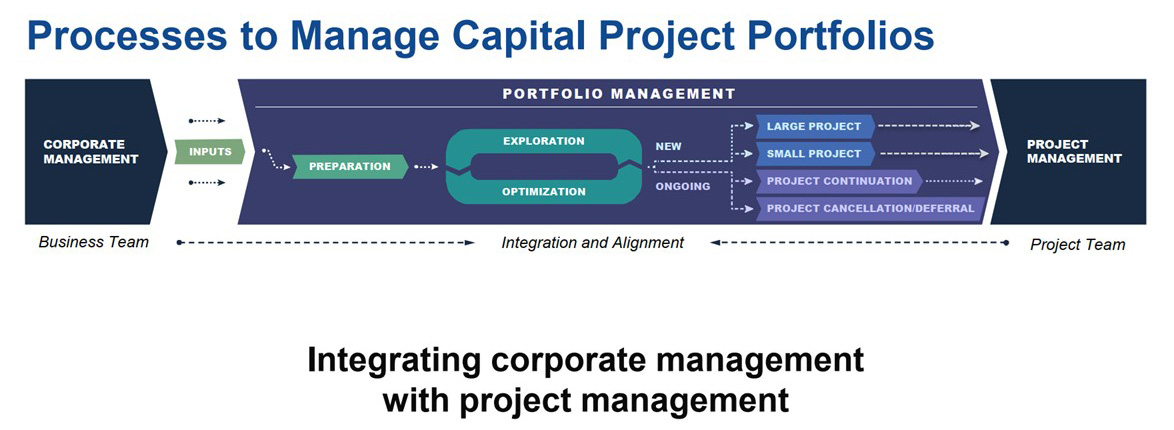

To address this issue, CII funded a research team (RT – 394, Improving Capital Effectiveness and Efficiency to Delivery Excellent Business Results) to investigate what considerations need to be addressed when selecting the opportunities that best support the business objectives of our owner organizations. The team was tasked with investigating ways to improve capital effectiveness and efficiency through better alignment between business and project teams. The team was to identify activities that would benefit from this alignment, as well as practices that have been successfully implemented to achieve this purpose. Although this effort would extend from inputs to the portfolio management phase through the transition to the front-end planning phase, the focus was primarily on the portfolio management phase.

This research effort broke down the various levels of this process as follows:

Corporate Management Inputs

-

Corporate Mission, Vision, and Values

-

Corporate Goals

-

Capital Plan

-

Safety, Compliance, and Regulatory

-

Market Analysis

-

ESG Analysis

Portfolio Management

Preparation

-

Define portfolio objectives, processes, and oversight.

-

Assign portfolio team including roles and responsibilities.

-

Provide information systems and implementation tools.

-

Identify requirements and targets.

Exploration

-

Engage relevant parties.

-

Assess ongoing project process regarding performance.

-

Assess portfolio performance.

-

Identify and evaluate potential new projects.

Optimization

-

Frame and define expectations for new large capital projects.

-

Frame and define expectations for new small capital projects.

-

Approve continuation and improve ongoing projects.

-

Cancel or defer ongoing projects.

This process, as defined by CII’s RT – 394, helps organize the owner's thoughts concerning building a project portfolio that best suits corporate business goals while executing projects with the highest level of confidence in their respective cost and schedule goals.

Please refer to CII Implementation Resource 394-2 for An Interactive, Integrated, and Structured Approach to Portfolio Management.

ABOUT THE AUTHOR

Steve Cabano

Steve is President/Chief Operating Officer for Pathfinder, LLC, and has over 30 years of direct Project Management experience for Owner, Contractor, and Government clients in various industries.

slcabano@pathfinderinc.com

856-424-7100 x122